One of the many frustrating aspects of the Community Infrastructure Levy regime is the confusing and limited nature of any right to appeal, which is particularly concerning given the varying interpretations given to the Regulations by different collecting authorities.

The first difficulty is working out what the appeal route in any particular situation is.

Appeals lie to the Valuation Office Agency in relation to:

⁃ Regulation 114 (where an interested person has asked the collecting authority for a review of the chargeable amount as is aggrieved at the decision on the review)

⁃ Regulation 115 (apportionment of liability)

⁃ Regulation 116 (charitable relief)

⁃ Regulation 116A (exemption for residential annexes)

⁃ Regulation 116B (exemption for self-build housing).

Recent VOA appeal decisions are here.

Appeals lie to the Planning Inspectorate in relation to:

⁃ Regulation 117 (decisions by the collecting authority to impose a surcharge)

⁃ Regulation 118 (determinations by the collecting authority of a deemed commencement date)

⁃ Regulation 119 (imposition by the collecting authority of a CIL stop notice).

Recent Planning Inspectorate appeal decisions are here.

A common theme in relation to the VOA and PINS appeals decisions is the frequency of misunderstandings as to the CIL regime on the part of those carrying out minor developments, the frequency of notices being missed or overlooked and forlorn attempts to avoid or reduce liability at a stage when development has already commenced and the horse has bolted.

Appeals can then proceed to the High Court if either of the parties considers that the decision of the VOA or PINS was wrong in law.

In relation to decisions of the collecting authority which are not listed above, for instance as to whether any exemption or relief should be granted other than charitable relief, the exemption for residential annexes and self-build housing – say social housing relief – the only possibility for challenge is for by way of an application to the High Court for judicial review. Not only is that a disproportionately cumbersome route for challenge when the issue could surely be dealt with by the VOA or PINS but, given that the possibility for claiming a relief or exemption is lost if it is not granted before development is commenced, few developers have the luxury of being able to wait for resolution of a disagreement over the relief or exemption before starting construction.

Surely all of this needs looking at again and simplifying as part of the Government’s current review.

I started thinking about all of this when reading what may be only the third High Court ruling in relation to CIL liability issues, R (Giordano Limited) v London Borough of Camden (Lang J, 13 December 2018). It’s a pretty straightforward case but I’m still not sure whether there was a VOA decision (and if not why the challenge was allowed to proceed) – maybe someone out there can help?

The issue was whether, in determining the relevant floorspace within the chargeable development, the test in Regulation 40 (7) (ii) was met as to whether there were “retained parts where the intended use following completion of the chargeable development is a use that is able to be carried on lawfully and permanently without further planning permission in that part on the day before planning permission first permits the chargeable development.” The floorspace represented by such parts wouldn’t attract CIL.

The claimant was intending to implement a planning permission for “change of use of third floor offices (class B1a) and vacant first and second floors (class B8) to create 3 x three bedroom flats.” Having received a liability notice for £547,419.09, it argued that the test was met because there was a previous planning permission which had been lawfully commenced for “change of use of third floor offices (class B1a) and vacant first and second floors (class B8) to create 6x two-bedroom flats (class C3), including rear extensions at first, second, third and fourth floors and associated external alterations.”

Under the previous (pre-CIL) permission, the rear extension and alterations to the elevations of the building had been completed, and steel beams refitted internally, but the first, second and third floors were just stripped out, unpartitioned floors and were not yet capable of being used for residential purposes.

The claimant was attempting to rely on the floorspace deduction provided for in Regulation 40 (7) (ii) because it couldn’t show that any part of the building had been lawfully occupied for at least six months in the previous three years.

Lang J found that because the floorspace was currently incapable of being used for residential purposes it did not meet the test – a “potential” future use was not sufficient.

Stepping back, I would say that was a pretty large windfall for the local authority!

The only other two High Court cases I’m aware of are:

R (Orbital Park Swindon Limited) v Swindon District Council (Patterson J, 3 March 2016), where the claimant succeeded in mitigating its potential CIL liability by securing two separate planning permissions for its proposed works to a retail store, one of which permissions, for the introduction of additional space by way of a mezzanine, was not liable for CIL.

Patterson J had no difficulty with the deliberate CIL mitigation strategy adopted:

“There is […] no manipulation of the system for any ulterior and/or illegal motive in accordance with the submissions of the defendant. Rather, the claimant has taken advantage of the legislative scheme which permits it to submit, in this case, two separate planning applications for each act of operational development that it wished to pursue. If it was not the intention of the legislature to permit that to occur then it is for the legislature to change it. At present, in my judgment, that is the consequence of the current statutory scheme.”

R (Hourhope Limited) v Shropshire Council (HHJ David Cooke, 2 March 2015), where the claimant failed in its submissions that the “in lawful use” requirement for deduction of floorspace would be met by anything less than actual use – it was not sufficient that the building (a former pub) was still available for lawful occupation, or that there was some residual storage of items left behind from when the pub had closed.

Is anyone aware of any others?

MCIL2

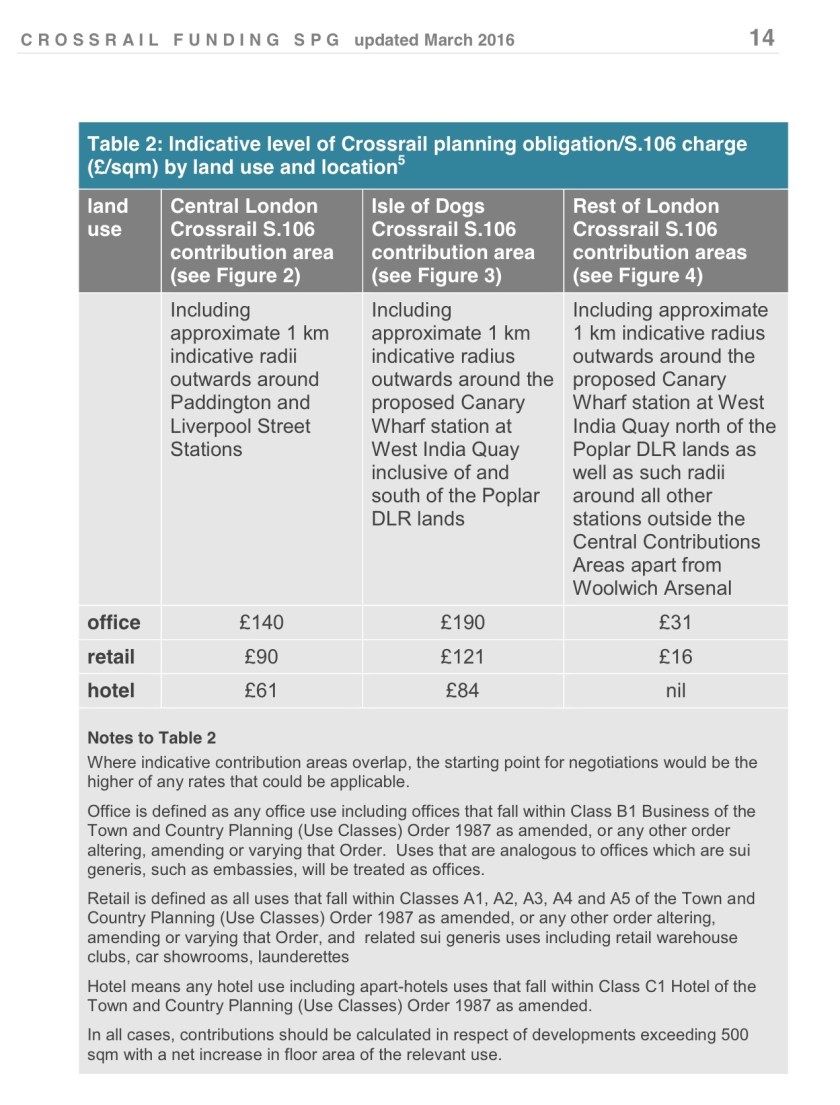

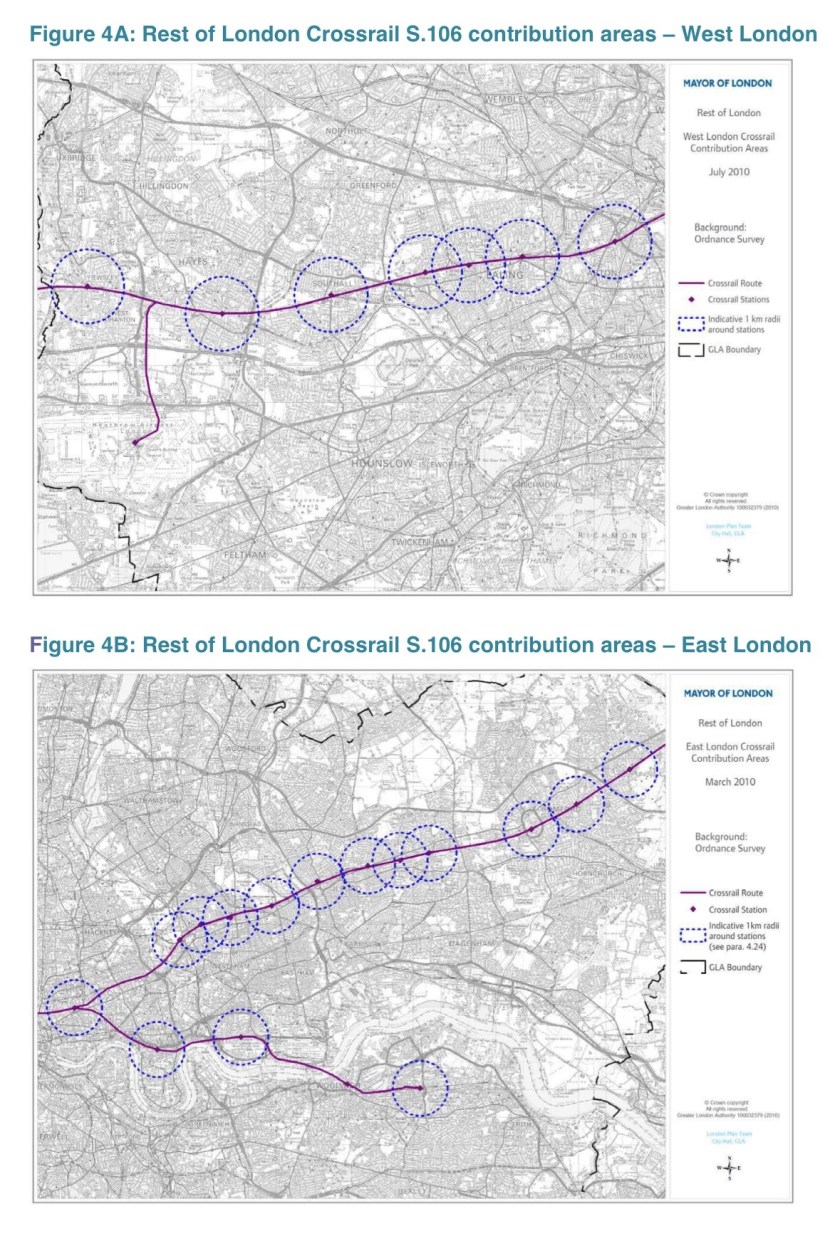

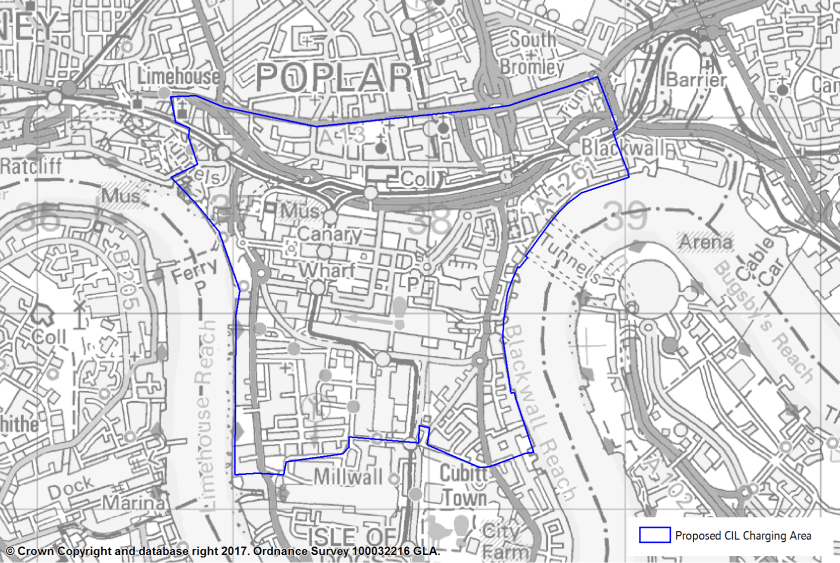

While talking about CIL, I thought it might be worth a brief post script about the Mayor of London’s MCIL2 (previously covered in part of my 9 November 2018 blog post An Update On CIL: Reform Promised, Meanwhile Continuing & Increasingly Expensive Uncertainties). The report of the examiner, Keith Holland, has now been published, recommending, with one minor modification, that the submitted charging schedule is appropriate, meaning that we can expect it to be adopted and take effect on 1 April 2019.

Despite the increasingly big question mark that there must be over whether Crossrail 2 (the basis for MCIL2) is politically deliverable at present (see my 1 July 2017 blog post Crossrail 2, Where Are You?) Mr Holland has no difficulty on that score:

“In 2016 the National Infrastructure Commission recommended that Crossrail 2 be taken forward as a priority with the aim of opening in 2033. Costings for the project have recently been subject to an independent review. The results of the review are not yet public and at this stage there is no formal government approval for Crossrail 2. However, the need for new infrastructure to support the region’s growth was endorsed by the Secretary for State for Transport in July 2017 and there is no doubt that an extremely strong case can be made for Crossrail 2. Moreover, there is general endorsement for Crossrail 2 from those making representations.”

Of course many of us want to see Crossrail 2 proceed. But what if it doesn’t? That’s a lot of money being raised without a defined objective as to the transport projects to which it is to be applied and surely it would be wrong for it to end up being used, for instance, to address cost overruns in relation to Crossrail 1?

Simon Ricketts, 15 December 2018

Personal views, et cetera

Charles Alfred Meurer, Still life with money, pipe and letters, 1914