I tried DLUHC in wordle but the app didn’t accept it.

Never mind – there was one significant announcement from the Department this week which I thought would cause more of a stir than it did, an announcement which could be really positive news for all of us who have been anxious for a long time that one of the operational failings of the current planning system is how long appeals take, such that in many instances, no matter how difficult it may be to make progress with the local planning authority, appeal is not a practical remedy (and perversely the delays are currently worse for smaller schemes than for schemes where any appeal is likely to be determined by way of inquiry).

The Department has now announced by way of a letter from housing minister Christopher Pincher to Sarah Richards, chief executive of the Planning Inspectorate dated 20 January 2022 (but published on 26 January 2022) that:

“As an initial milestone in making more consistent, timely decisions The Planning Inspectorate should be working towards consistently achieving decisions in these ranges:

· Appeals decided entirely using writing evidence in 16 – 20 weeks

· Appeals decided including at least some evidence through hearing or inquiry 24 – 26 weeks (30 weeks to recommendation for called in or recovered cases)”

These targets for written representations appeals and hearings are new.

Detailed measures are set out for:

• The proportion of appeals which are valid on first submission

• How long appeal decisions take from valid receipt to decision

• Customer satisfaction.

These measures apply regardless of the legislative basis for the appeal, for example whether it is in relation to enforcement or resulting from the refusal of a planning application.

These targets and measures should make a real difference.

But there is a much more radical coda to the letter:

“As you know, the Government is also committed to improving and modernising the planning system. The work you are undertaking to develop twenty-first century digital public services is an important part of this. I would welcome you complementing that by identifying what steps might be necessary to achieve a further significant consistent improvement in appeal timescales beyond those above so that most appeals could be consistently decided in 4 – 8 weeks, or faster, whilst maintaining good standards of decision. Consideration can then be given to whether these steps might be appropriate.”

Yes, you read that correctly – an aspirations that “most appeals could be consistently decided in 4 – 8 weeks, or faster”. PINS director operations Graham Stallwood spoke at a Clubhouse session last week about what steps PINS is taking towards digitalising its processes (a replay of the whole event is here and Graham’s comments are from 53 minutes in). It will be interesting to see what further changes will be recommended to procedures to achieve anything like those timescales.

The Planning Inspectorate’s response dated 27 January 2022 welcomes the new measures. PINS will “start reporting on them to ministers and customers straight away as part of our monthly statistical release and performance updates.”

There is this statement from Sarah Richards:

“I welcome the minister’s request to report to him on what would be necessary to support a further significant improvement in appeals. This recognises the importance of a fair appeal system to the nation’s economy and is an important opportunity to reflect on how the appeal system can be reframed to operate sustainably for the future. We will engage with key stakeholders on this in due course before we report to the minister.”

My understanding is that PINS is likely to be starting that process this Spring. There will be no Bridget Rosewell overseeing it all this time round. No doubt it will in part be an equivalent series of pragmatic incremental gains in terms of efficiencies and timescales but I would have thought that some statutory timescales set out within secondary legislation may need to be revisited. And let’s not be under any illusion: “4-8 weeks appeal timescales” are going to need significant changes in terms of processes but also behaviour:

• (As discussed by Graham at the Clubhouse event) how can we get to a position where on appeal a link can simply be provided to the documents on the LPA’s planning portal rather than starting a wholly new paper chase, and appeal submission can be pass/fail in terms of submission of the correct documents, as if you were applying for a passport?

• What fresh evidence should be allowed to be submitted at the appeal stage (and what does this mean in practice for those preparing their applications – at application stage your documents will need to be forensically prepared so as to be “appeal ready”)?

• What should decision letters look like?

• How do we avoid unintended consequences given that on these timescales, it will usually be quicker to appeal as soon as you can rather than engage in protracted negotiations with the LPA – and so will the appeal system very quickly get clogged up?

• Will any necessary trade-offs as between on the one hand an element of procedural flexibility and on the other hand speed prove counter-productive for prospective appellants? Is there a point at which appeals become too quick? And what resources will be required on the part of LPAs and third parties to be able to participate effectively?

• Not mentioned, but are we going to see appeal fees introduced, at least for some types of appeal?

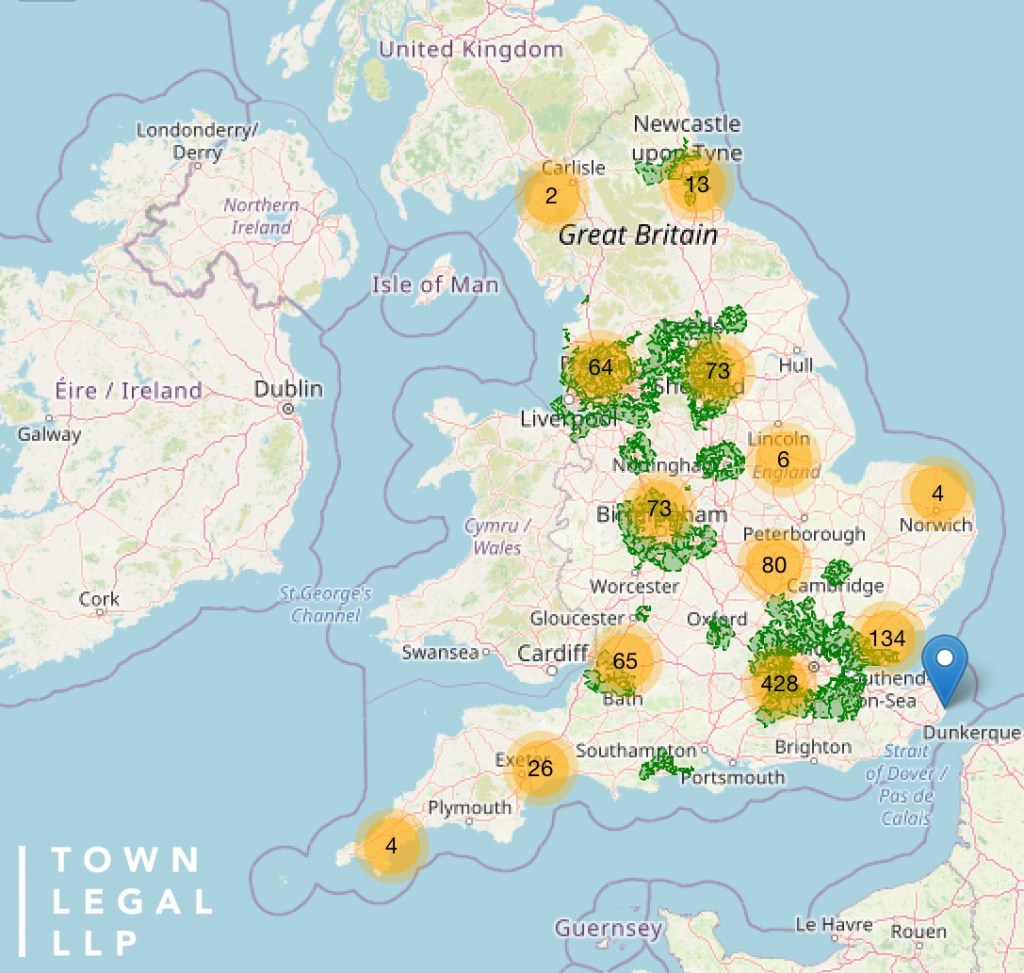

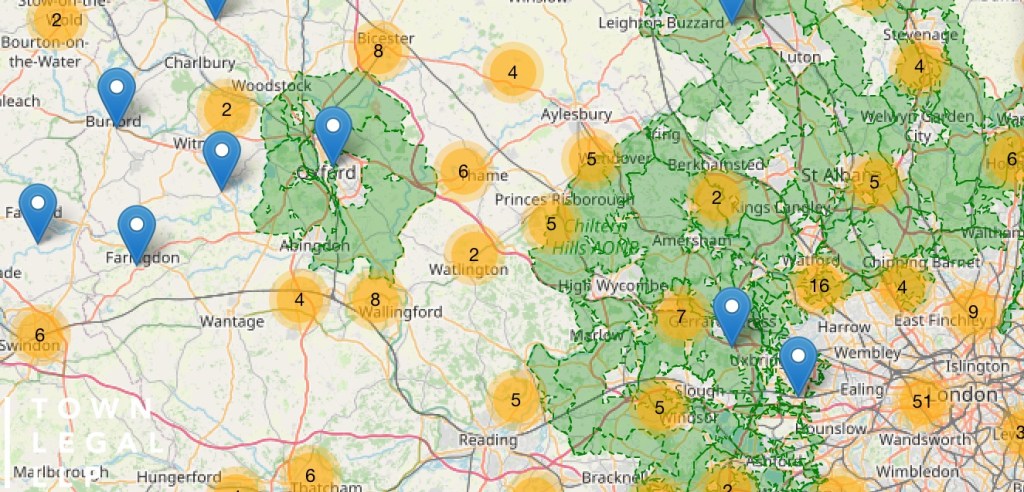

This is all a long way from the current performance statistics (20 January 2022):

We will be talking about all of this at our Clubhouse session at 6 pm on Tuesday 1 February. At this session we don’t have any special guests because we want to hear from you. Your current experiences of the system, good and bad, and what you think of these proposals. Whether you are a planning consultant, local authority planner, community group representative, advocate or developer, what do you think? Link to app here.

Simon Ricketts, 28 January 2022

Personal views, et cetera

PS I know there have been distractions around those parts recently but it is still startling to see a ministerial letter with a phrase such as “until such time as me or my successors agree new measures”. Yuck. (Or should that be YUHC?).